Bringing better connectivity to the nation is a key priority for many in the telecoms space. But achieving this common goal is no mean feat. It requires incredible foresight and significant capital investment to develop networks that not only offer reliable connectivity solutions, but also capacities to match a fast-changing and often unpredictable future.

Since our initial investment in our exchange footprint in 2016, we haven’t looked back. Today we have one of the fastest growing B2B networks in the nation spanning 34,000km, 90 on-net data centres, 676 points of presence and 550 exchanges, all of which serve millions of businesses across the UK.

We spoke with our Business Development Director for Wholesale, Simon Willmott, to discuss why the exchange roll-out project was so important and how it has benefitted our 400+ partners to deliver better connectivity across the UK for their customers.

Why has Neos Networks invested in unbundling exchanges?

We recognised early on the importance of business connectivity services, like Ethernet and Optical, and how they, and the bandwidths that comes with them, can help better serve fast-paced, growing businesses.

A few years back we launched our Ethernet investment programme, Project Edge. We initially identified 54 exchanges in highly populated business regions to connect our services into. The investment quickly paid dividends and the rest, at they say, is history. Today, Project Edge has seen us unbundle 550 exchanges and we’re proud to be able to serve near-on 750,000 business postcodes across the nation.

Does Neos Networks plan to invest further in its network in 2022?

Quite simply, yes. At the end of last year, we announced an exciting new initiative for the business, bringing high capacity direct fibre access to the door of businesses in four key business districts; London, Liverpool, Birmingham and Manchester. This metro access project will enable us to provide direct last-mile connectivity services to nearly 34,000 regional business and office locations, allowing us to deliver full end-to-end connectivity while bypassing third-parties like Openreach.

In addition to this, we’re already well underway in analysing a new tranche of exchanges to be added to our network and are also looking to broaden our data centre presence.

How have you seen the industry change over the last few years?

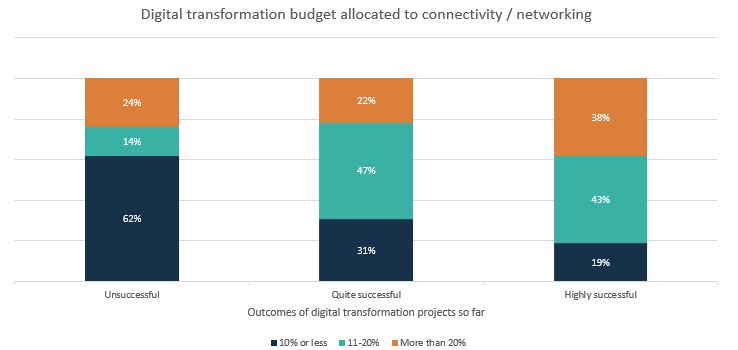

It’s evident to us that the market is seeking out higher capacity services than ever before, particularly following another tricky year with the pandemic that led to many businesses re-evaluating their IT strategy once again. As part of our Edge investment, we therefore made sure to increase the capacity of our exchange network.

Today, most of our on-net exchanges offer Ethernet services up to 10Gbps as standard with NNIs and Optical connectivity available up to 100Gbps. This not only gives our resellers access to bandwidths to suit an advancing market, it also allows them to backhaul connectivity using our network, gaining access to exchanges through Neos Networks rather than having to invest themselves.

For an industry where just a few years back, 1Gbps Ethernet services were enough to support business requirements, the move to 10Gbps connectivity feels like the natural next step for many.

What does your exchange programme mean for your wholesale partners?

By offering high capacity connectivity services out of 550 exchanges we enable our partners to take advantage of our well established, highly reliable fibre infrastructure which in turn provides you and your customers with more choice and better availability.

More excitingly, our entire network and connectivity services can be accessed via our online pricing and ordering tool, LIVEQUOTE. This allows our partners to compare pricing for our Ethernet, Internet Access and Optical products against other key UK suppliers in a matter of minutes. And because our reach is now so extensive, we’re confident that where a requirement falls directly onto our network, we will more often than not offer the most competitive rates as well as the best route to market.

To discuss a partnership or gain access to the quoting and ordering tool, contact the team at Neos Networks today on [email protected].