- Executive summary

- The Altnet squeeze: navigating competition, capital constraints and regulation

- Reshaping UK broadband: putting customers first

- Partnering for long-term success

- Standing out to stay ahead

- Conclusion: a critical juncture for the future of UK connectivity

- Methodology

Executive summary

As a vital part of the UK’s connectivity landscape, Altnets have been a positive disruptive force, challenging long-reigning incumbents. The billions they’ve attracted in investment have been instrumental in accelerating the UK’s fibre rollout, spurring new fibre builds across the country. Since their inception in 2018, Altnets have now made fibre available to over 40% of UK premises, contributing to the UK's full-fibre broadband rollout, which is set to reach 96% of homes and businesses by 2027, according to Ofcom.

But with increased competition in the market and the right incentives from government, the incumbents have also doubled down on their efforts to deploy fibre-to-the-premises (FTTP). The result is that many Altnets are now struggling to generate the revenue needed to ensure longer term sustainability. Consolidation is starting to pick up speed as investor caution increases in the face of lagging customer growth.

Simply put, the Altnet market has reached a critical juncture. Neos Networks spoke to Altnets across the UK to investigate the challenges they currently face in the market and the different strategies they’re exploring to redefine themselves as mainstays in the UK’s connectivity landscape.

The Altnet squeeze: navigating competition, capital constraints and regulation

Overbuild and increased market competition (challenge 1)

The competition with incumbents has often been a race to see who can build new fibre the fastest. As incumbents seek to maintain their market share and Altnets seek to grow theirs, the UK has become a patchwork of network overbuild. In many areas, premises can choose between three or even four providers for their fibre.

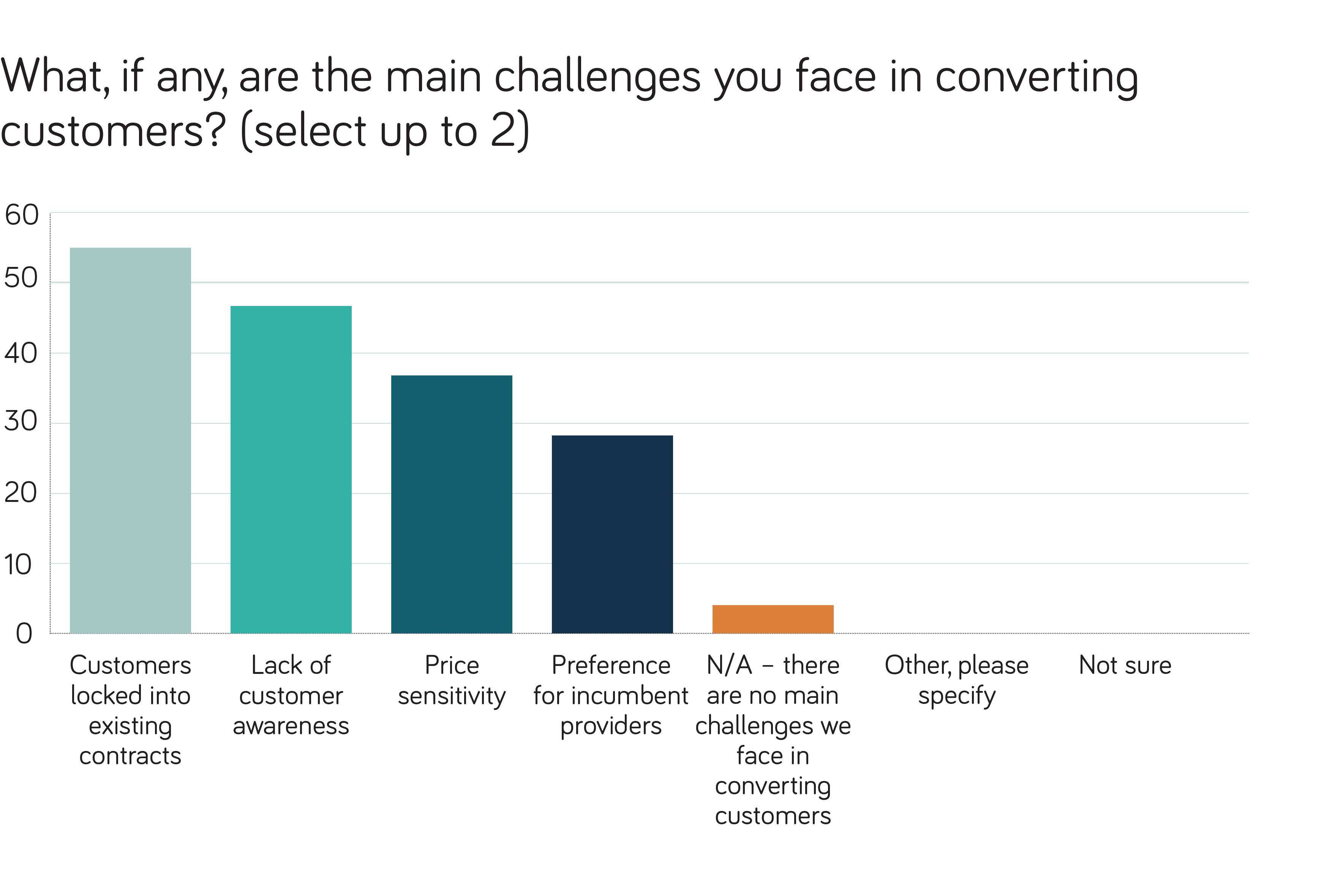

In these decisions, incumbents have the upper hand. While passing homes might have been the initial goal for Altnets, getting customers to sign up to these services is another challenge. Incumbents are buoyed by historic brand equity, making it harder for Altnets to compete, with 34% of Altnets suggesting brand awareness is the greatest challenge getting in the way of their goals.

In many cases, it comes down to who got there first. 55% of Altnets said that customers being locked into existing contracts was a significant struggle for them, limiting their ability to generate subscribers where they’ve built their networks. Understandably, consumers are accustomed to providers like BT, Sky or Virgin Media, and switching to an unfamiliar provider can sometimes feel like an unnecessary hassle or even a risk.

Despite initiatives like the One Touch Switch scheme being introduced to simplify ISP switching, it still doesn’t solve the issue entirely. With so many customers preferring to bundle broadband with other services like TV and mobile, switching to a broadband-only Altnet provider seems like a step backwards. It’s here again that the market power of the incumbents comes into play, with their pre-existing relationships allowing them to super bundle services across entertainment, gaming, fitness and more through a single subscription.

Financial pressures (challenge 2)

The tough economic conditions affecting the wider market have been similarly tough on Altnets. Build costs have been steadily rising as they’ve continued expanding their footprints, making customer acquisition even more vital.

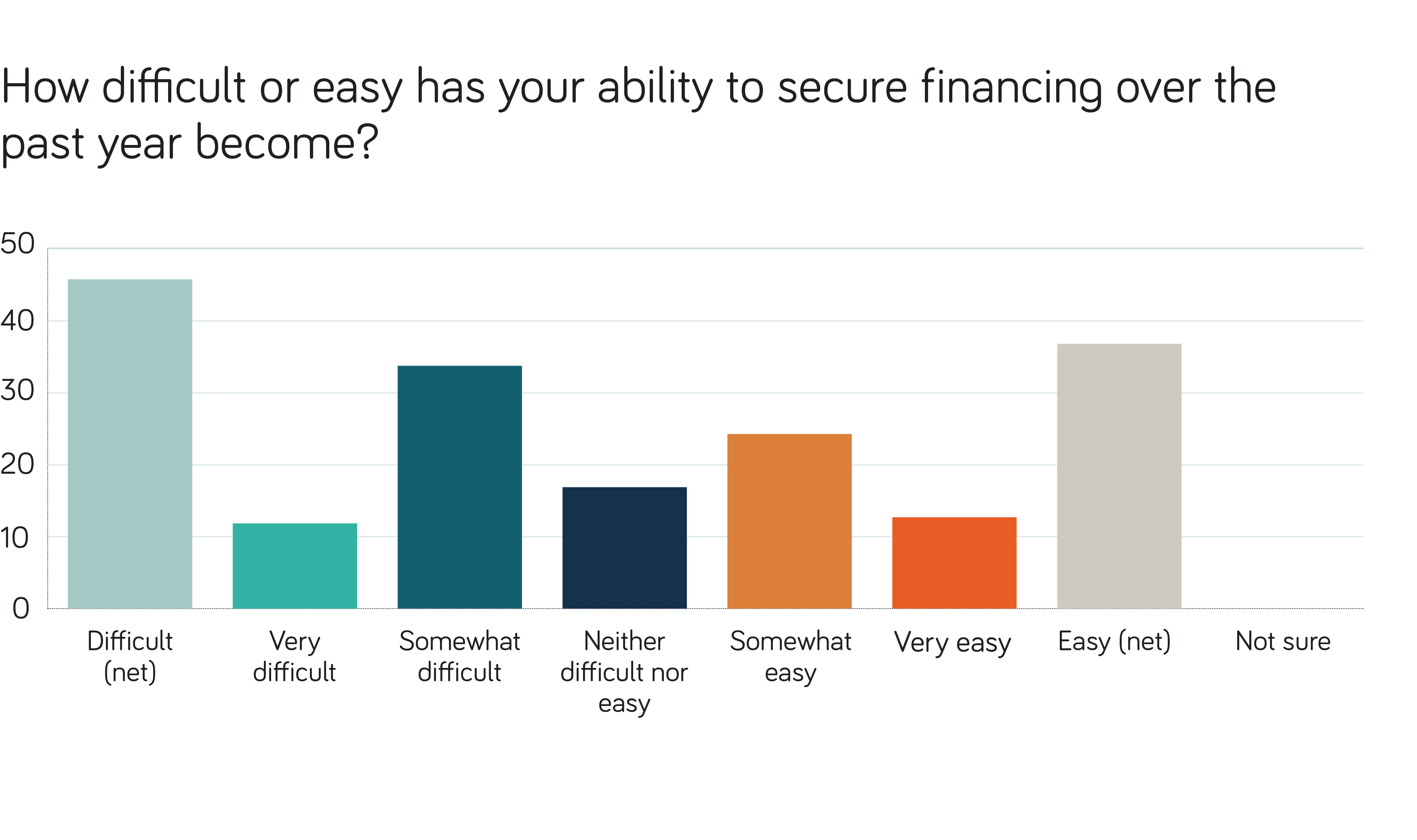

Where funding may have previously been more accessible, investors too are turning their attention towards take-up as the key measure of ROI, causing a hesitancy to invest further. As a result, nearly half of Altnets (46%) said that it’s become more challenging to access funding over the past year.

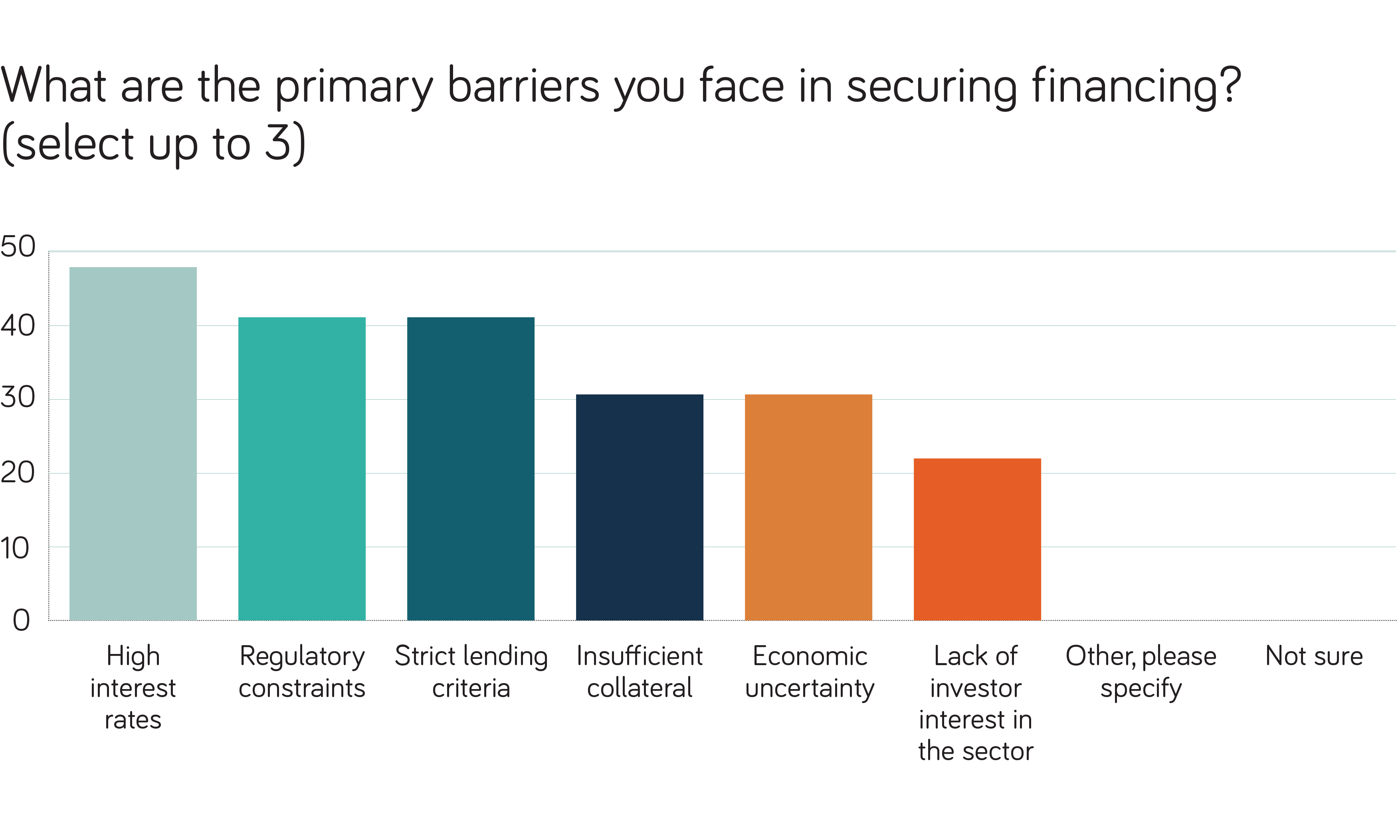

High interest rates are only exacerbating this challenge, with 48% of Altnets citing them as a primary reason behind their struggle for funding. Regulatory constraints (41%) and strict lending criteria (41%) were also significant barriers as Altnets look to secure financing.

Apart from the inflationary pressures impacting build and the difficulties accessing funding, our research revealed another notable financial challenge. As BT continues to reduce the number of PSTN exchanges in use over the next decade, Altnets reliant on these locations face gaps being left in their networks – gaps that will be costly to close. On average, Altnets reported that the closures will cost them £1.4m (see appendix), according to our findings.

Regulation (challenge 3)

According to our research, regulatory barriers (38%) remain the most cited external factor hindering Altnets from achieving their wider goals.

The regulatory picture continues to evolve with the new Telecoms Access Review published for 2026-31. However, in aiming to balance investment with competition, Ofcom has recognised (and sought to remedy) the significant market power of Openreach, while also supporting market conditions in which they have traditionally taken advantage of this monopolised position.

“Our Altnet partners have been very clear about some of the structural challenges that deter competition and limit private investment in key regions. As an example, they’ve highlighted a tactic whereby Openreach announces FTTP expansion plans for specific areas without firm deployment timelines. This strategy discourages Altnets and investors from committing to those areas, as they fear being undercut by Openreach's rollout at a later stage. And in many cases, Openreach has then delayed or deprioritised those announced deployments.”

Lee Myall, CEO of Neos Networks

It’s easy to see how this stymies competition and could slow down nationwide coverage targets.

But beyond this, the Independent Networks Cooperative Association (INCA) has also raised concerns in a number of other areas, including inaccurate estimates of Altnet costs impacting fairness and competition calculations. They’ve also alleged that Openreach has purposefully overbuilt in areas where Altnets have been awarded Project Gigabit contracts to take advantage of the attention to pick up customers.

INCA continues to raise a number of such concerns about Openreach’s market advantage, reporting claims of favourable pricing being given to internal customers and suggesting that Openreach’s “incumbent advantage” allows them to overbuild competitors. While INCA has suggested restrictions that could be introduced to limit Openreach’s advantage, any action will be a long time in the works. For the time being, Altnets will have to reckon with Openreach’s purported advantages.

Reshaping UK broadband: putting customers first

Even without the issue of overbuilding, as challengers to incumbents, Altnets were unlikely to ever compete individually from a reach perspective. At last count, Openreach covered 17 million premises, with the largest Altnet CityFibre trailing behind at coverage of 4.3 million premises.

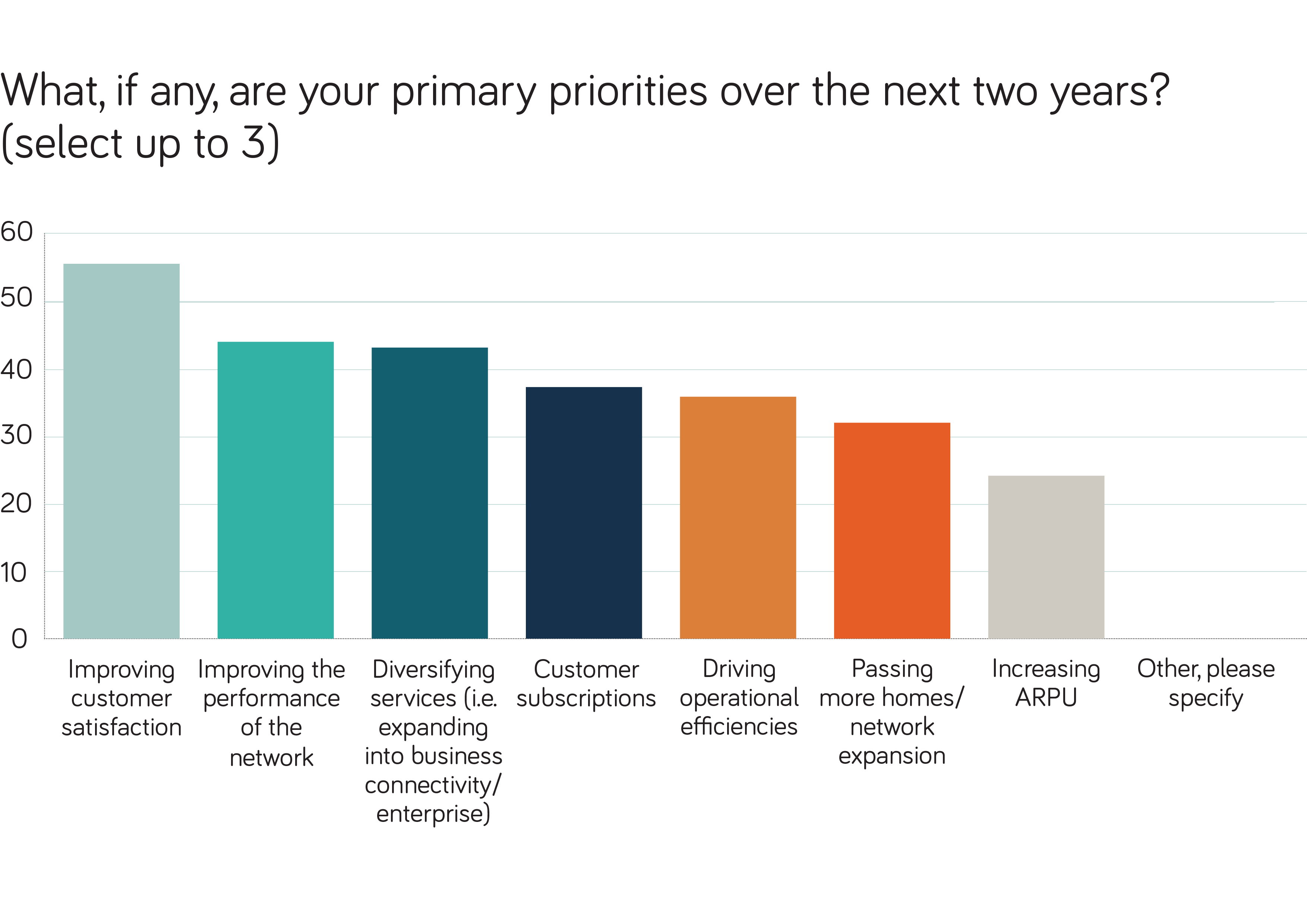

Instead, they’ve taken a different approach, trying to change people's perceptions of connectivity providers. Where incumbents are often presented as faceless utility providers to their customers, Altnets have instead engaged directly with their local communities to put customer satisfaction at the heart of everything they do. They’ve made this such a central part of their strategies that 55% of the Altnets we surveyed say that improving customer satisfaction is their primary goal for the next few years – a motivation that ranked ahead of other, more revenue-critical objectives such as increasing customer subscriptions and driving operational efficiencies.

This aim is evident in how Altnets have operated since they entered the market. Unlike incumbents, they’ve frequently partnered with local councils, hosted community events, and involved residents themselves in planning decisions as they considered their rollouts. The focus seems to have paid off so far: Altnets consistently have far better customer satisfaction scores when compared to legacy providers.

The customer-satisfaction imperative has been a critical differentiator and successful strategy to pin their hopes to, but as Altnets look to the future at what seems like a critical juncture, we wanted to look at how this focus might be evolving as they mature.

However, while the customer-first approach has served Altnets well, our survey suggests a recognition that to achieve long-term success in the market, a strong dedication to customer service alone isn’t enough. The Altnets we spoke to are exploring varied and diverse strategies that seek to marry that customer-centric approach with strategic expansion and vital tech-driven innovation.

Partnering for long-term success

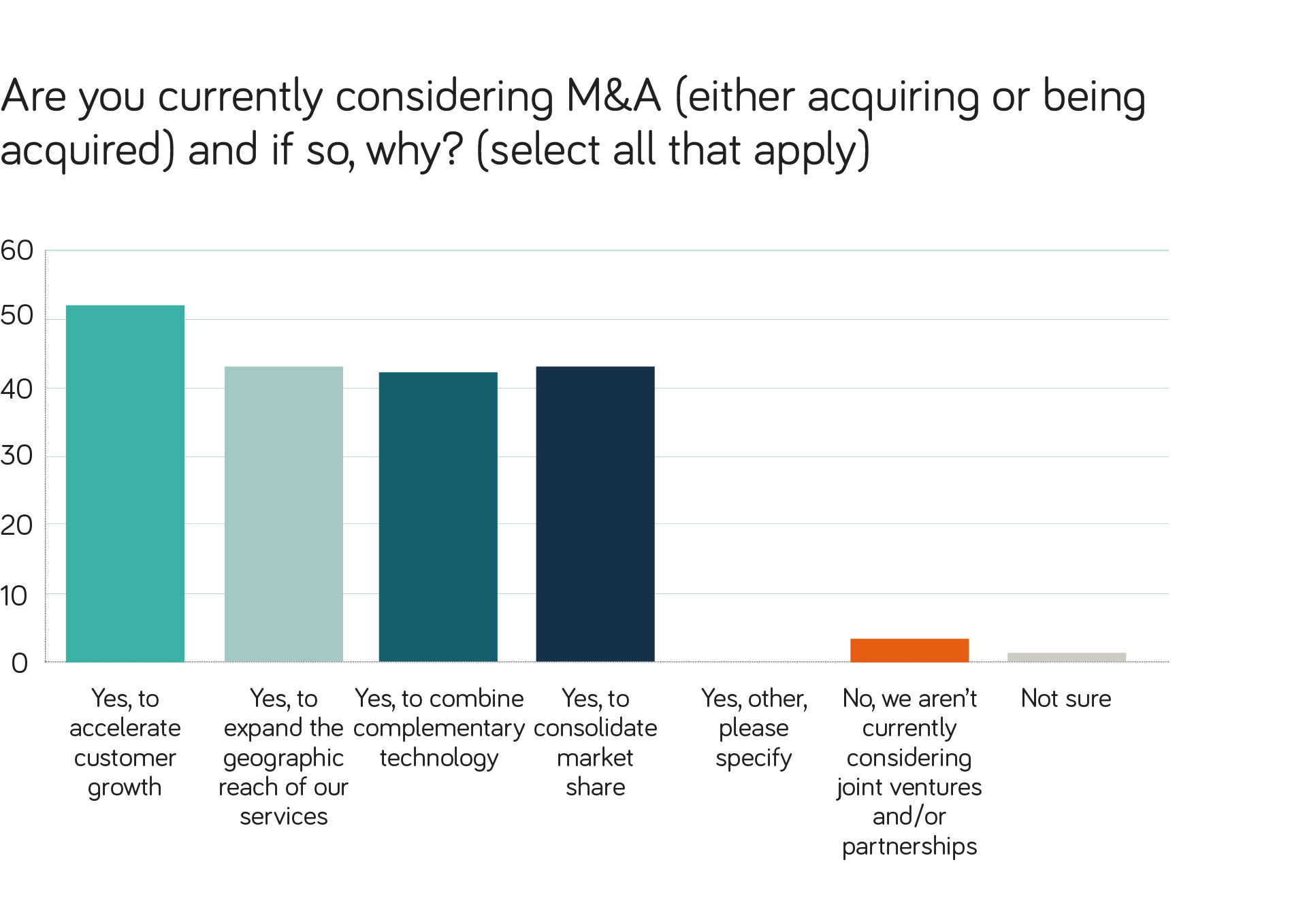

In keeping with the industry expectations of consolidation, partnerships of varying descriptions were a popular move for the Altnets we spoke to. In fact, the overwhelming majority (96%) reported that they're planning partnerships with other service providers to expand their reach.

It’s clear that they recognise a customer-first approach can only take you so far in their struggle to grow customers. For those looking to expand their customer base at pace, partnerships are by far the easiest route. So it makes sense that for over half (52%) of Altnets, accelerating customer growth was their main motivation for pursuing partnerships.

Many Altnets may have started out specialising in fibre built-outs in specific, underserved areas, but with full-fibre coverage now reaching 7 out of 10 households, it’s clear this strategy has limitations. Altnets recognise this, with 43% highlighting expanding geographic reach as a major driver behind their partnership efforts. With increasingly limited regions left in the UK without coverage, accelerating new fibre builds no longer make sense as a viable commercial strategy. Instead, expanding into new areas through partnerships with existing providers is becoming a far more attractive option to expand reach whilst minimising risk.

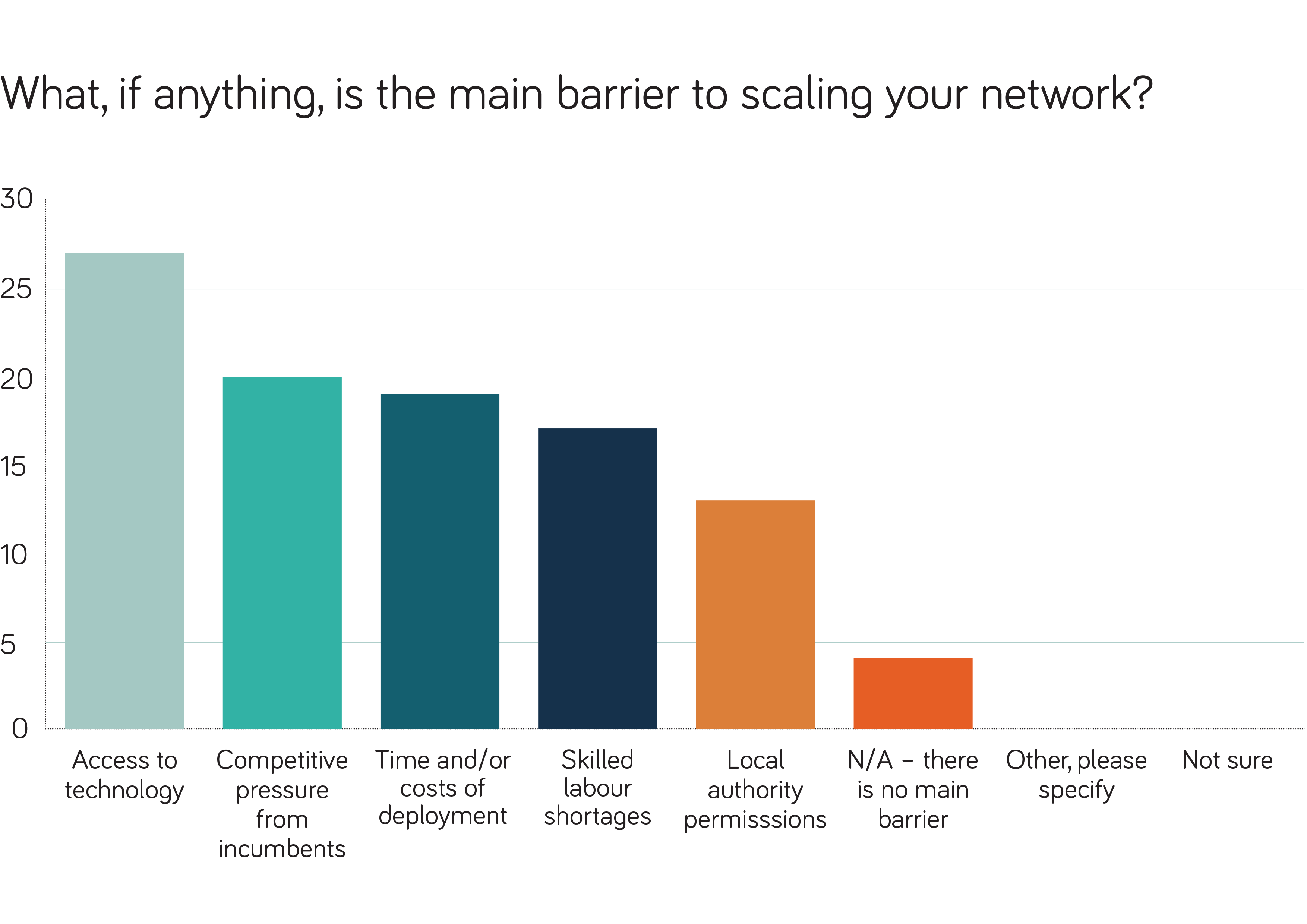

Scaling their networks – and with that, their customer base and profitability – is a clear and feasible solution. But, as our research shows, there are several barriers that Altnets need to surmount to get there. Incumbent rollout competition (20%), technology access (27%) and deployment resources (19%) were all identified as significant blockers to network expansion.

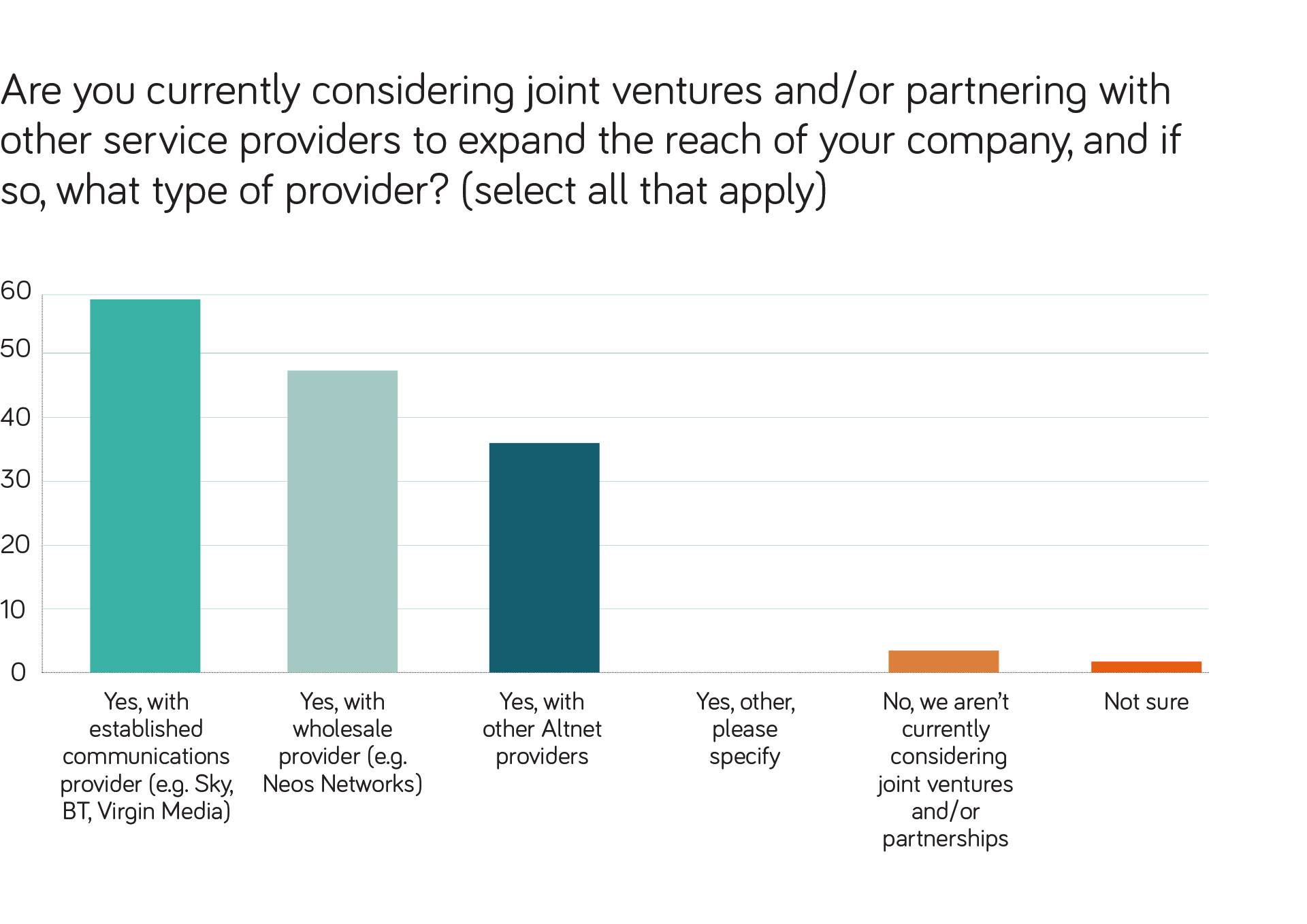

Many are turning to established service providers, with 56% planning to partner with them. And understandably so. This has already been successfully demonstrated by CityFibre and TalkTalk, who first partnered to allow TalkTalk to sell consumer broadband via CityFibre’s network, before expanding to include Ethernet. This ongoing partnership has unlocked an additional 100 locations for TalkTalk, extending their reach while allowing CityFibre to further monetise their network investments.

Another route for Altnets is to partner with wholesale providers to expand their reach – connecting disparate networks and backhaul traffic. 48% of Altnets are already considering this. Some may be looking to extend their own reach, while others may seek to connect their acquired footprints together following acquisitions or mergers. By working with a core or transport partner, Altnets can continue to offer the same agility, flexibility and support that their customers have come to expect, making it a popular option.

Neos Networks-LightSpeed case study

Partnering with a wholesale network provider is a strategy many Altnets have already found success with, as demonstrated by Neos Networks’ partnership with LightSpeed. The Altnet was looking to expand its FTTP to additional premises across the Midlands and East of England and turned to Neos to leverage its UK-wide network. With access to Neos’ infrastructure, LightSpeed is able to connect to premises at pace while maintaining its connectivity quality and driving sign-ups.

However, partnering with external providers always carries some risk. For Altnets, finding a similar cultural ethos and technical synergies will be essential. Having built their reputations as customer-service-focused providers, Altnets will need partners with the same dedication. If not, they could extend their reach but at the expense of their reputation, making it a questionable endeavour. In this vein, you might expect Altnets to partner closely with their peers, yet only 36% plan to partner with other Altnets.

Why is this? Bain & Company estimate that a fibre network requires a take-up rate of 35% to be commercially viable long-term. And with over 100 Altnets active in the UK at last count, the maths simply doesn’t add up. Last year, the Altnet average take-up was just 15%. While other Altnets might be the perfect cultural fit, there isn’t room for everyone in this new consolidated market.

Standing out to stay ahead

Establishing productive partnerships, or merging with another provider, is a sure-fire way to extend reach, but growing average revenue per user (ARPU) is equally important. Ultimately, many are exploring methods to further differentiate themselves, offering top-end technology or even packaging additional services.

Becoming an Altnet-of-all-trades

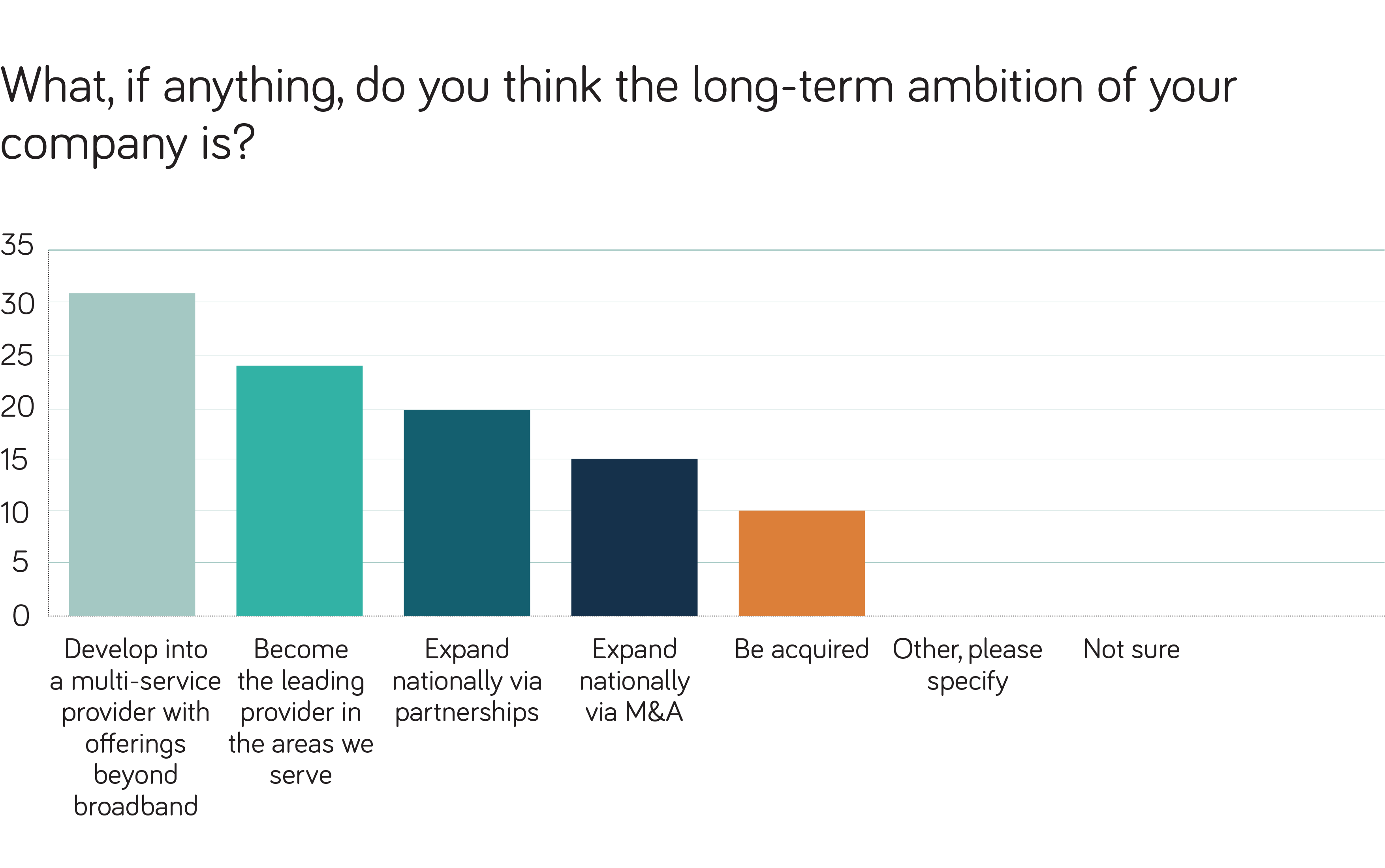

When asked what their main long-term ambition was as a company, aspiring to become multi-service providers beyond just broadband came out on top.

Altnets recognise that, apart from network expansion and integration, to gain additional market share they will also need to differentiate themselves beyond their customer service credentials. For most, brand awareness is one of the major barriers, but by branching out beyond residential broadband, they can differentiate their services, unlock new revenue opportunities and encourage loyalty.

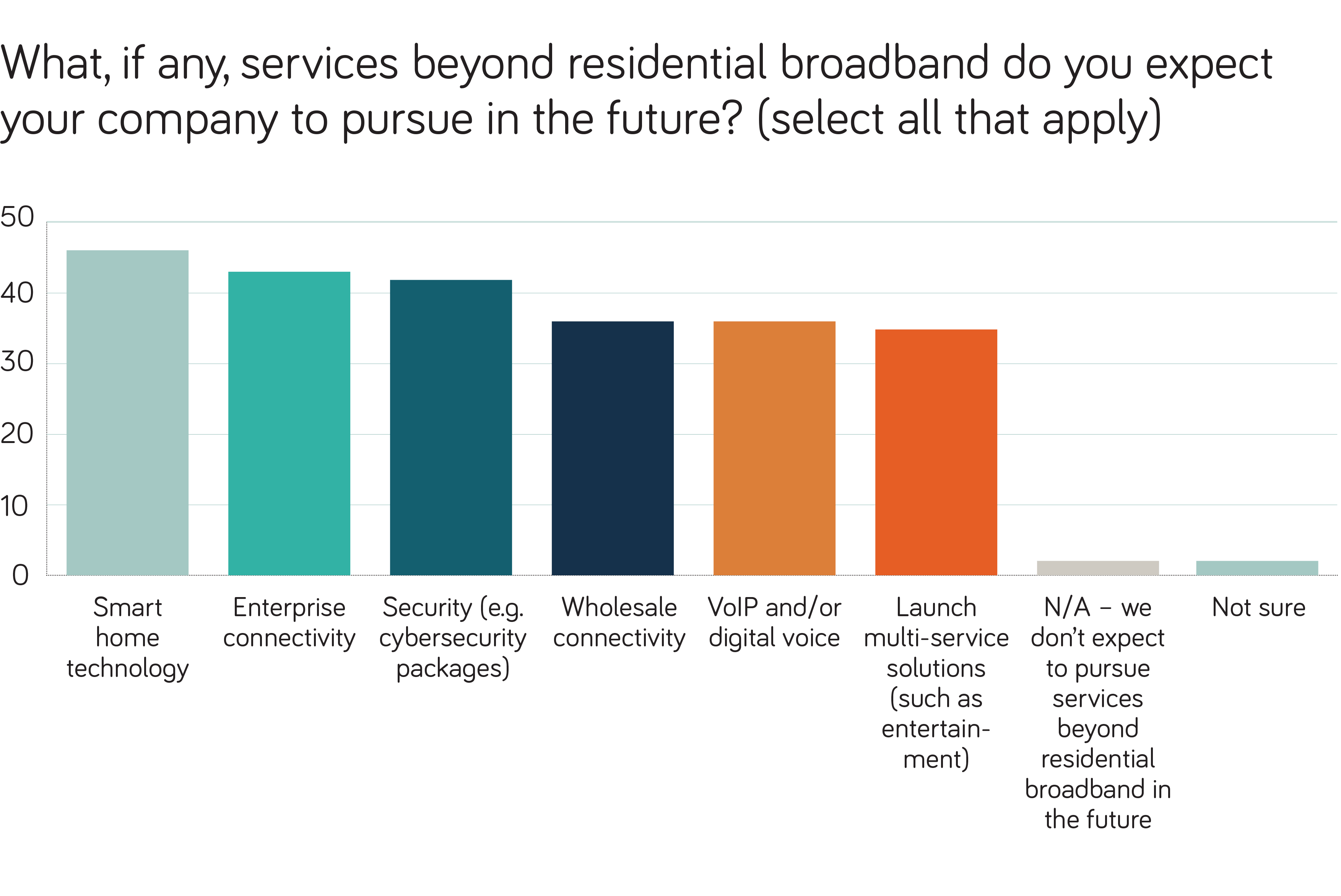

Many are already looking to deploy additional products and services. Expansions into smart home tech (46%), enterprise connectivity (43%), and security (42%) ranked as the most common services that Altnets are looking to implement in the future.

Security offerings (40%), and 5G Fixed Wireless Access (39%) are also seen as major areas of innovation for Altnets.

Community Fibre case study

One provider already putting this strategy into action is Community Fibre:

- Currently offers several broadband, TV/streaming and security bundles.

- Saw an 85% increase in its customer base last year, bucking the Altnet trend.

- Continues to keep a customer-first focus, with three times more 5* Trustpilot reviews than VMO2, Sky and BT combined.

Network technology for a competitive edge

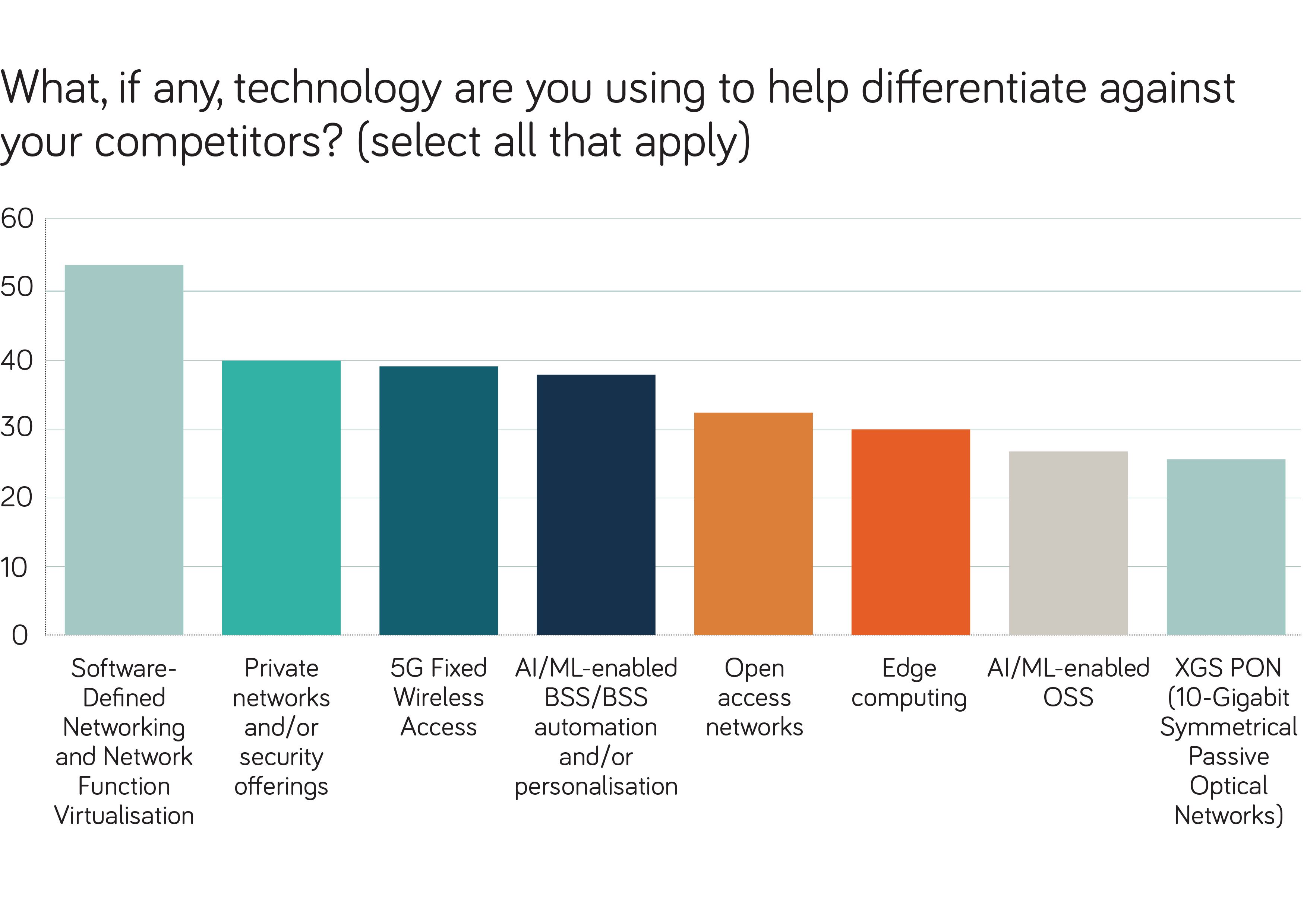

Perhaps unsurprisingly, when asked what technologies they were using to help differentiate themselves from their competitors, most respondents said they were deploying Software-Defined Networking and Network Function Virtualisation (53%). This technology-driven approach gives Altnets a competitive edge by enabling cost-efficient, agile and scalable network operations, while the incumbents are often locked into legacy infrastructure.

As the top technology-related investment priorities focus on agility, private networks and/or security offerings (40%), 5G Fixed Wireless Access (39%) and AI/ML-enabled BSS/BSS automation and/or personalisation (38%) are not far behind. However, these priorities also reflect a broader shift towards technologies that better align with customer preferences.

Conclusion: a critical juncture for the future of UK connectivity

Altnets have been a driving force in transforming the UK’s connectivity landscape, accelerating the full-fibre rollout and challenging long-standing incumbents. However, the market has now reached a critical juncture. With intensifying competition, financial pressures and evolving regulatory frameworks, it’s clear that Altnets will need to adapt swiftly to secure their long-term position.

Thankfully, as our research pointed out, Altnets are trialling a range of solutions – from embracing strategic partnerships and leveraging wholesale opportunities to expand their reach and build sustainable growth, to technology and service differentiation while prioritising a continued commitment to customer experience – to move beyond their disruptor roles.

The decisions made now will define the future of UK connectivity. Altnets that evolve, integrate and innovate will not only endure but help shape the next era of digital infrastructure. By adapting their strategies and working together, they can transition from challengers to essential pillars of the UK’s broadband ecosystem, ensuring they stay at the heart of UK connectivity while delivering the choice and service consumers expect.

Methodology

Neos Networks commissioned Censuswide to survey 100 senior decision-makers at UK-based Altnets. The survey was commissioned in January 2025.