This report was created by UK dedicated internet access provider and transport and logistics telecoms specialists, Neos Networks. If using data or other material from the report, please do so with the appropriate credit with a link to this report page.

According to the Department of Transport, the freight and logistics sector is ‘critical to our economic wellbeing, ensuring the flow of goods along our supply chains is reliable and efficient’. In 2019 alone, 154 billion tonne-kilometres (tkm) of UK domestic freight goods were transported by road, compared with just 25 billion tkm by ship, and 17 billion tkm by train.

There is, however, a downside to this. In 2020, HGVs and light vans were responsible for 19% (18.6 Mt CO2e) of the UK’s total domestic transport greenhouse gas emissions (98.8 Mt CO2e). Transport (including passenger transport) causes more emissions than any other: it’s responsible for 24% of all greenhouse gas emissions in the UK. So it’s not surprising that at last year’s COP26, the logistics industry was a key focus for decarbonisation targets.

In July 2021, the UK government released the Decarbonising Transport plan. Setting out aims for delivering a zero-emission freight and logistics sector, it states:

“Decarbonising the last mile will create cleaner, more liveable places and there is scope for greater use of artificial intelligence and data tools in the freight sector. This could improve efficiency and cut emissions, particularly for the many small operators in a fragmented industry. "

In June 2022, the government’s Future of freight report outlined the role of technology and data-enabled opportunities in improving the efficiency, reliability, resilience and environmental sustainability of the sector.

In the wake of these two important reports – and to better understand the green tech freight landscape – we asked UK transport and logistics (T&L) operators:

- Whether they’re implementing the decarbonisation targets into current operations

- What barriers they experience in meeting decarbonisation targets

- What they need to reach these targets

- What role real-time data could play in achieving decarbonisation targets in the near future

Key findings:

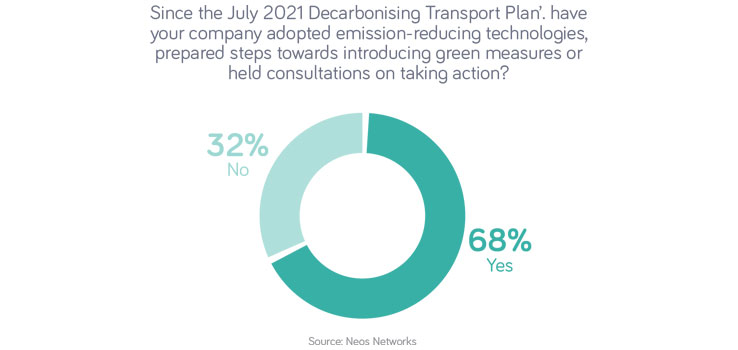

- Industry action — More than two-thirds (68%) of T&L companies have taken steps towards green tech since the Decarbonising Transport report

- Going green — Over half (55%) of UK T&L firms will take measures to decarbonise fleets by 2024

- Data is key — 55% of UK T&L firms say greenhouse gas and carbon data tracking is a core part of decarbonisation plans, over the next two years

- Capacity is a challenge — A third (35%) who can’t use data to reduce carbon don’t have the core connectivity to share large amounts of primary supply chain data

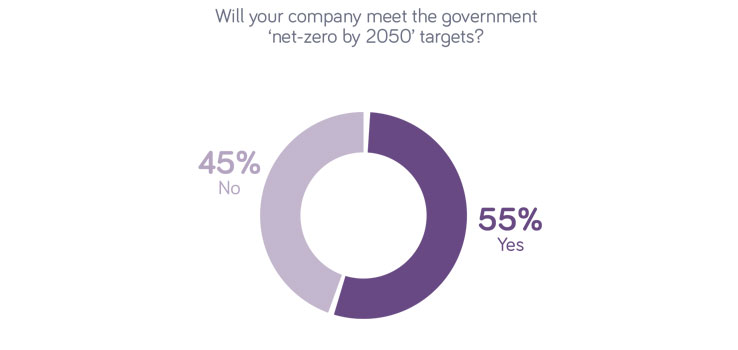

- Long-term goals in question — 45% of T&L companies don’t believe they’ll hit the ‘net-zero by 2050’ pledge

- Convincing needed — 45% of companies don’t see battery electric vehicles (BEVs) as currently commercially viable, while 68% feel the same way about AI and data learning

- Investment squeeze — three in five operators (61%) say the high cost of investment is the biggest barrier to achieving targets

One year on: how many companies have taken steps in a greener direction?

A year after the government released the Decarbonising Transport plan, what steps has the industry taken to lessen its impact on the environment?

More than two-thirds (68%) of transport & logistics companies have adopted emission-reducing technologies, prepared steps towards taking green measures, or held consultations around putting plans in place.

By contrast, almost a third (32%) of T&L firms haven’t made any moves at all towards emission reductions.

There’s an urban/rural gap, which surprisingly reveals urban firms are less likely to be making efforts to cut emissions. Some 36% of companies in towns and cities have made no attempts to make operations greener.

Outside of urban areas, only one in five (20%) T&L firms haven’t taken action, meaning that 80% of companies are trying to reduce emissions, or heading in that direction.

Levels of green activity also differ according to company size. Enterprise-level organisations are most likely to be environmentally friendly, with 77% of them on the path towards becoming greener. Two-thirds (67%) of SMEs are also on that path, while large companies are slightly less likely (60%) to be making emission-cutting moves.

Is sustainability on the short-term agenda?

With an uncertain economic climate in the UK, how much are T&L companies looking towards the future? And if they are, where does their focus lie?

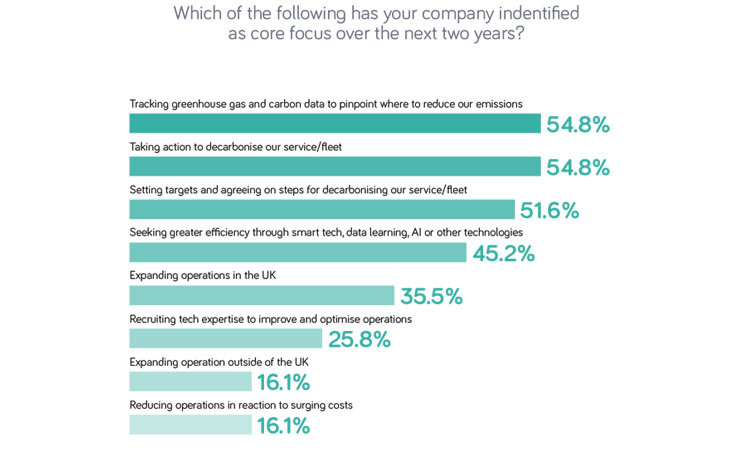

It’s clear that many T&L firms are prioritising green/decarbonisation initiatives over the next two years. If all goes to plan, by 2024 we should see significantly reduced carbon emissions from the sector, with more than half (55%) of UK T&L operators actively seeking to decarbonise their service/fleet. While 52% of companies are making preparations to do the same.

Using data can greatly speed up the process, and 55% of UK companies are including greenhouse gas and carbon data tracking in their immediate plans. In addition, 45% of companies plan to adopt smart tech, data learning, AI or other technologies for greater operational efficiency.

A drive for efficiency is proving more popular among T&L operators than expansion plans. Almost 50% more operators are seeking to reduce emissions or decarbonise than those looking to expand in the UK. When it comes to expanding outside of the UK, green initiatives are over three times (240%) more common as a short-term goal.

For all the attention devoted to becoming more efficient, however, only a quarter (26%) of firms are planning to recruit tech experts to optimise their business. This implies that there will be a surge in demand for outsourced data analysis and tech troubleshooting.

What approach does the industry favour for reducing carbon-emissions?

For decarbonisation technologies and policies to achieve widespread uptake, the industry must believe in their commercial viability. However, our research highlights a lack of consensus on the best way forward, which makes it more difficult to implement change.

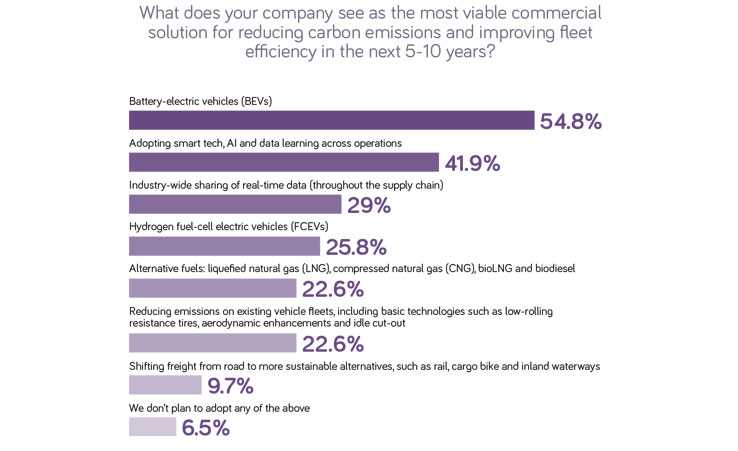

94% of T&L companies plan to adopt one or more solutions for reducing carbon emissions, in line with the UK government’s Decarbonising Transport plan, taking steps to improve fleet efficiency in the next five years or so.

For most of these companies, the most commercially viable solution involves a combination of alternative fuels – notably battery electric vehicles (BEVs) – and digital systems such as smart tech, AI and data learning. Twice as many firms believe BEVs are commercially viable as believe alternative fuels can represent a solution.

Those companies hoping to use smart tech and real-time data to become greener will need to invest in core connectivity, which government incentives can encourage. Technology development for proof of concept return on investment can also drive greater adoption of green initiatives.

How important is core connectivity to decarbonisation success?

By investing in core connectivity, companies will acquire the capacity to collect and process the real-time data needed for smart technology and the integrated tech of the future. Both smart tech and findings from data will contribute to increased efficiency and decarbonisation.

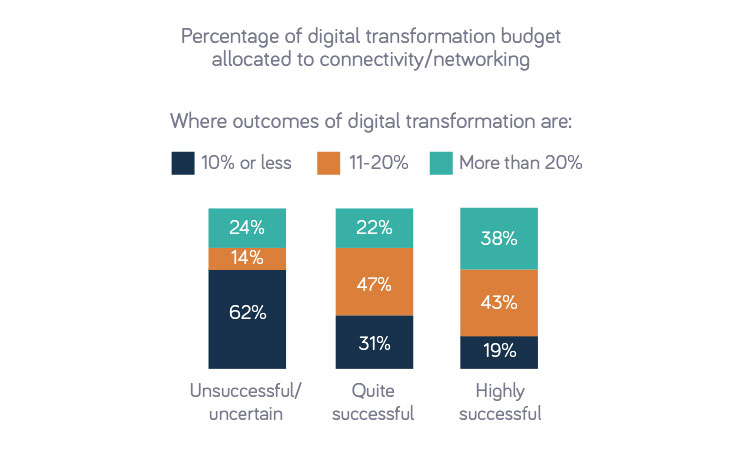

As reported in the Neos Networks ‘Core connectivity: The key enabler of digital transformation’ ebook, under-resourcing connectivity and networking is linked with less successful digital transformation projects. Conversely, organisations which budget for connectivity properly are much more likely to deliver highly successful digital transformation programmes.

The research shows that where more than 20% of the budget for digital transformation projects is allocated to connectivity and networking, 38% of companies rated the outcome of the project ‘highly successful’. By contrast, projects with 10% or less dedicated to connectivity and networking were unsuccessful in 62% of cases.

Does the size of the company influence the green solution?

Our research shows that the use of AI and data learning is universally favoured as a solution for decarbonisation by firms of all sizes. When it comes to other options, however, companies of different sizes have differing opinions.

SMEs:

Smaller businesses are nearly twice as likely (42%) to see industry-wide sharing of real-time data (throughout the supply chain) as a feasible way to reduce emissions. This shows, perhaps, their eagerness to embrace a cost-effective method.

When it comes to alternative fuel types, BEVs are most popular among SMEs, with 58% seeing them as a real way forward. SMEs are also more likely than other businesses to back alternative fuels like liquefied natural gas (LNG), compressed natural gas (CNG), bioLNG and biodiesel.

Enterprise-size companies:

In contrast to SMEs and enterprise-size firms don’t see liquefied natural gas (LNG), compressed natural gas (CNG), bioLNG and biodiesel as a realistic option: just 8% state they’re a commercially viable solution. Enterprise-level companies support BEVs as the most viable solution (38%), followed closely by fuel cell electric vehicles (FCEVs).

What does the industry think of meeting net-zero targets by 2050?

To meet the net-zero by 2050 target, it’s clear that the transport and logistics industry will need more technology, greater industry buy-in and assistance in the form of government policy.

Given the efforts required, how many companies are confident that the target is realistic?

The industry is split on this question, indicating that more work is needed to galvanise operators. Just over half of the UK’s T&L companies think they can meet government decarbonisation targets by 2050.

Companies with greater resources are more confident: 64% of enterprise-level companies believe they can meet the target, compared to 45% of SMEs.

What obstacles to this are operators experiencing?

Before motivated organisations can get anywhere close to reaching net-zero targets, they must first identify the factors preventing them from adopting a greener way of operating.

- Three in five operators (61%) say high investment costs are seen as the most common barrier to achieving targets.

- Almost twice as many firms cited cost as a barrier than the next factor on the list (with 35%): a lack of industry tech knowledge or shippers favouring low costs over green operations.

- A quarter (26%) stated a lack of national fuelling and service infrastructure was an issue, which obviously needs government intervention.

Which sectors are supporting green changes in freight?

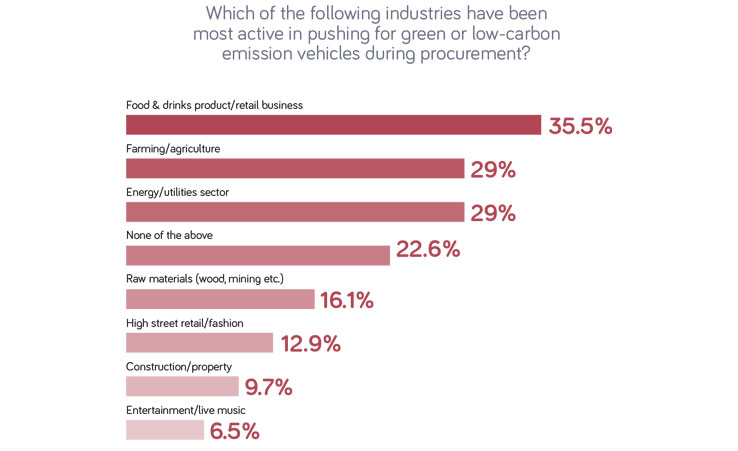

With a third (35%) of T&L companies being deterred from decarbonisation by shippers who pressure them to run cheap operations, it’s clearly a common issue. Even if firms are eager to become greener, they must strike a balance between remaining commercially competitive and investing in emission reduction.

T&L customers obviously influence companies’ policies, yet nearly a quarter (23%) of companies can’t identify a single industry in their supply chain that’s pushing for greener practices.

The data divide: Where smart systems, data and connectivity meet net-zero emission targets

Our report shows that T&L companies recognise that collecting and acting on real-time data can reap great sustainability benefits, helping them take steps towards net-zero targets. The data can be used to aid smart tech, AI and, of course, data learning.

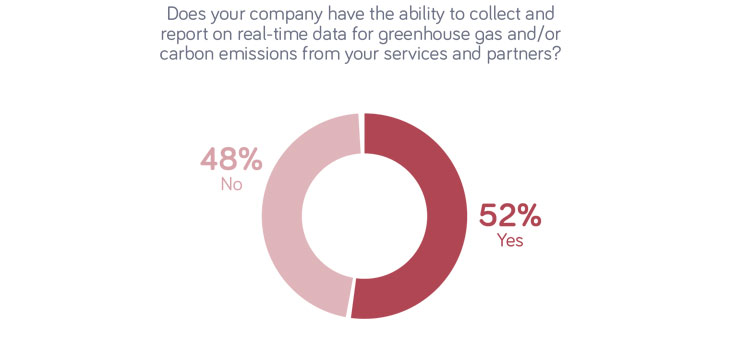

Although more than half (52%) of the industry can access the necessary data, there’s some way to go before we see a totally data-connected industry. As it stands, almost half of the companies in T&L are not utilising greenhouse gas / carbon emissions data to clean their operations up.

There’s even further to go in rural areas, where 6 in 10 companies can’t use such data. Even if companies like this are trying to go greener, they might be doing it in an ineffective way. They need greater investment to level-up their data-collecting and reporting capabilities.

How many transport and logistics companies use real time data to its full potential?

Over half of T&L companies have the ability to collect and report on real-time data on greenhouse gas and/or carbon emissions. Yet how many can use this data to actively reduce their carbon emissions?

Even among the 52% of companies who can access accurate and up-to-the-minute data, just 71% of them feel confident using the data to improve operations. Just under a half (42%) use it to become more efficient, while 29% employ it to boost customer service levels.

As we’ve mentioned, core connectivity has a great bearing on data-gathering capabilities. Of those firms unable to use data to make practices greener, one in three (35%) say inadequate capacity or core connectivity is stopping them from sharing large amounts of data. Around a fifth (19%) can’t share more significant amounts of data and don’t plan on remedying that situation in the next year. This is clearly an issue when it comes to implementing smart tech, which is a key strategy for decarbonisation.

Smaller numbers of companies say they either don’t see the value in sharing data or have security concerns, but the vast majority are willing to embrace the concept – some just need a helping hand.

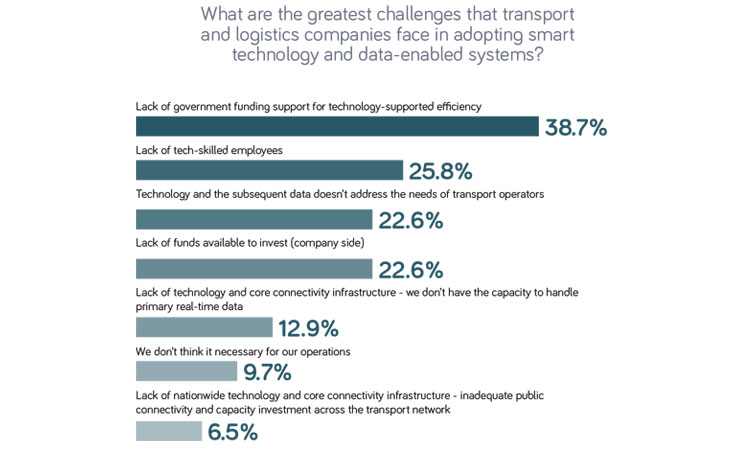

Other companies are trying to embrace data use and smart tech, but are finding roadblocks in the way. So what are the most serious barriers they’re coming up against?

What challenges do companies have to overcome in adopting smart data?

Whether or not companies can collect data that can be used to reduce carbon emissions, what do they see as the main challenges for using real-time data in green initiatives?

With over a third (39%) of firms citing a lack of government support, the message to government is loud and clear: more investment is required to move towards net-zero in 2050. Around a quarter (23%) also say their own funding is insufficient.

Over a quarter (26%) point to a lack of tech-skilled employees, which would mean that even if they can process the data from a technical viewpoint, they couldn’t achieve it without extra personnel on board.

Almost that number (23%) of companies simply feel that the type of data produced doesn’t meet the needs of the T&L industry, which could be something that awareness campaigns might remedy.

Do views change with company size?

SMEs:

Understandably, SMEs identify a lack of tech-skilled employees as an issue. Not all companies have the kind of resources needed, with 36% of SMEs saying they don’t have the required people on board.

Funding is another significant barrier for SMEs, with 18% stating they have insufficient funds for investing in smart tech and data – and more than a quarter (27%) wanted more help from government.

Large / enterprise companies:

Even with larger companies, insufficient government funding was an issue: 39% said more was needed if they were to adopt efficiency-enhancing tech. Of course, another factor for the government to consider is that larger organisations will obviously require more funding than SMEs.

The amount of data for processing is also more of an issue for larger companies – and one in five (21%) say they don’t have the tech and core connectivity to handle the data.

Conclusion

Many T&L companies are willing to invest in decarbonisation and have already acted since the government's Decarbonising Transport plan was released in 2021.

In the medium term, however, a large proportion of companies remain sceptical about the commercial viability of the technologies currently available. For example, 68% feel that AI and data learning aren’t commercially viable green solutions. The industry is also split on whether the net-zero goal by 2050 is achievable. Overall, there is more work needed to convince the market.

As well as government placing more emphasis on the tech – and more funding behind it – stakeholders such as consumers and T&L customers can exert more pressure to accelerate decarbonisation.

However, before the industry races towards a tech-led green revolution, companies must consider the role of data. To implement smart technology and benefit from real-time data, they need systems that can handle the amount of data. This is where core connectivity infrastructure comes in, laying the foundations upon which decarbonisation can progress.